Like any real estate investor, we all need training and refresher courses throughout our investment Career. I agree with this lady named, Susan Lassiter-Lyons, who does a really good job at outline what it takes to raise private capital. There are many myths about it but if you want to be a successful real estate investor, you have to check this out!

(Man, I sound like an infomercial. I am not getting anything out of this so don't worry about me selling you anything...lol... )

If you haven't raised private money, you should start. There's a lot of money out there. You just need to do it right and get people to TRUST and listen to what you have to say so you can present your investment opportunities.

I've spent over $70K to attend every real estate seminar out there out of fear, laziness, greed, and getting sold by these slick sales guys (Ron LeGrand, Robert Allen, etc.). What I've come to realize is that there's a lot of better and more informative materials online about real estate investing. If you take some time out to research and study, you will find great resources and maybe spend only about a few hundred bucks to educate yourself.

So this is my contribution to my fellow investors. I will sort through all the garbage and

only recommend the ones I think are realistic. This is my way of giving back to the investment community so I can save some aspiring real estate investors the disappointment, pain, and EXPENSIVE lessons of attending these stupid, mob-frenzy, unrealistic real estate Seminars where all they do is promise you the world, UP SELL you with the unrealistic guarantees that life is going to be easy, that the money is going to be rolling in, and you don't have to lift a single finger... They will turn you into a Zombie that will try to do what they "claim" they've done and repeat the same things they tell you to say. You are kind of like in this

trance where the only time you feel safe is when you are amongst the seminar going mobs. They give you scripts for you to try and repeat the same verbiage they probably used once or twice and it miraculously worked for them. And you will try it and it does not work so when you go back to ask them why it did not work, they will just tell you to return to the same seminar or go to another one for more training, that their friends have, and they will continue to milk you for more and more programs until you are FLAT broke! My advice:

Don't Do It!

News Flash, guys: Success doesn't come easy. There's no easy way out. There's no free lunch...sorry. But if you want success, you need to have perseverance, dedication, hard work and the opportunities will present themselves. Here's as real as it gets:

Hard honest work + perseverance + education + consistency + some luck = Results

If it's a good investment opportunity, the money will come!

Click on the links below to watch the videos on how to set up your real estate investment plan and how to do it with Private Money. You have any questions, contact me and we'll work together and I will try to help anyway I can. Enjoy!

Here's Video #1. Click on the link to Watch it:

The main point of Video #1 is Susan is trying to motivate you on how you can Strategically Put together a $1,000,000 Portfolio that will generate $2800/month Cash Flow using Private Money (if you don't have any money of your own). Folks, keep in mind that you are not going reach this goal by simply sitting on your hands until they turn white. Remember, she is just giving you the information and a very rough plan. You still have to put in a ton of work, hustle to find the deals, and spread your message to people about what you do in order to get to this goal.

It's a great informational video to watch and be inspired. But that's about it. You need to further educate yourself and go do some honest work. Video # 2 goes into depth about how to reach out to people for help and different ways to get funding for your projects. Again, great informational tools to learn so you should definitely watch it. She is very experienced and knows what she is talking about.

Here's Video #2. Click on the link to Watch it:

The main point for Video #2 is to try and get funding for your projects. If you are willing to do the work and find the deals but just don't have the capital, this is a good video to watch for tips on how to find money partners who can help you fund the deals. Honestly, you do need to sell yourself a little bit here (especially if you are new to this arena), but it should

not be a hard sale like sleazy life insurance or a timeshare salesman. You just need to let people who have money know that you can find great deals but need help with the funding. And if they like and

trust that you would do your best to invest their money wisely, they will help you out.

So the message you need to let people know is that you are an investor looking for deals:

"I structure lucrative deals together so that my partners and I can make safe, consistent profits and returns." If people inquire further, you can tell them:

"I have some deals in the pipeline, how about we get together to take a look?"

This is as much "selling" as you should do. If you just stick to these simple guidelines and continue to let people know that's what you do and you really are consistently looking and coming up with good deals, people will gravitate towards you when you do have those good investment opportunities.

NOTE: Beside watching these 2 Videos for the fundamentals and then learning more about it on your own, the rest of her stuff are disappointing "Seminar-Like" Sale Pitches: "Come to my seminar....blah, blah, blah...."

Don't get sucked into it... Best thing to do is slowly learn this stuff and gain the experience and knowledge yourself.

Don't just talk the talk, you also gotta walk the walk...

UNTIL NEXT TIME...

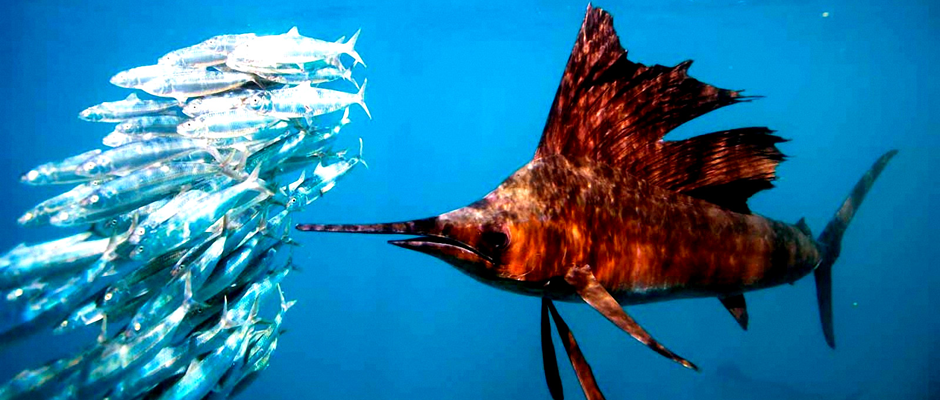

Some cool Pictures from my Phone to Enjoy: